We often hear about tariffs and trade wars on the news, but what do they actually mean for you and me? Let’s simplify it.

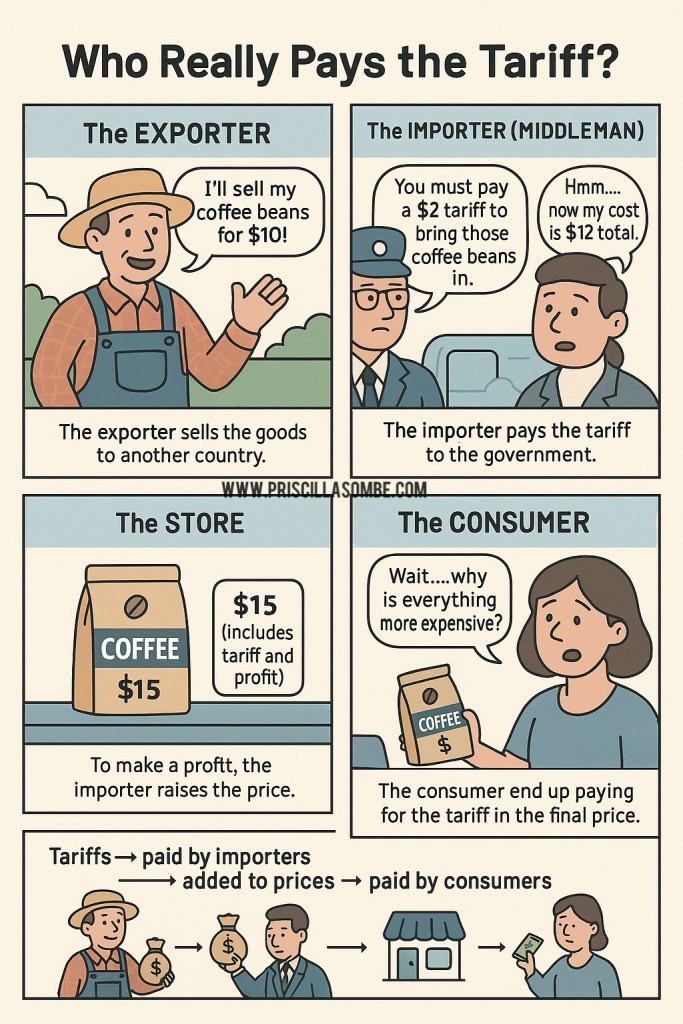

Imagine a coffee farmer in another country, that’s the exporter. They sell their coffee beans to a business in your country, the importer, also known as the middleman.

Now, here’s where it gets interesting: when the beans arrive at the border, the importer must pay a tariff, which is basically a tax charged by the government.

That means the importer now pays more for the coffee than what the farmer originally charged.

But importers are in business to make a profit, not to lose money. So what do they do? They pass that extra cost down the chain.

They add the tariff to the selling price.

The store then marks it up again.

And when you finally pick up that bag of coffee at the shelf, you’re the one paying for every tax and expense that came before.

In short, tariffs may start at the border, but they end at the checkout counter.

☕ Simple Breakdown:

• Exporter: Sells the product (for example, $10 coffee beans).

• Importer: Pays the tariff ($2 tax) → total cost becomes $12.

• Store: Adds markup for profit → price becomes $15.

• Consumer: Buys at the new price and unknowingly pays for the tariff.

🌍 Why It Matters

Tariffs are often used to protect local industries or balance trade, but they also mean higher prices for everyday consumers.

That’s why understanding how money flows through trade helps us see the bigger picture, and make smarter choices as buyers, voters, and entrepreneurs.

At the end of the day, every cost a business pays, from transport to taxes, eventually shows up in the final price tag.

So the next time prices go up, remember: sometimes, it’s not the store or the farmer raising prices. It’s the invisible ripple of a tariff working its way through the chain.

🪶 #EconomicsMadeSimple #TradeAndTariffs #FinancialLiteracy #PowerPoisedPriscilla #MindWonders #LearnWithPurpose #EverydayEconomics #GlobalTrade #WordPressBlog #ConsumerAwareness #SimpleEconomics

Leave a comment